Table Of Content

On a 30-year jumbo mortgage, the average rate is 7.63%.Current Mortgage Rates for April 25,... Use a mortgage calculator to figure out how changing interest rates might affect you. The lowest-risk rate locks are fee free and have a float-down feature.

Current mortgage and refinance interest rates

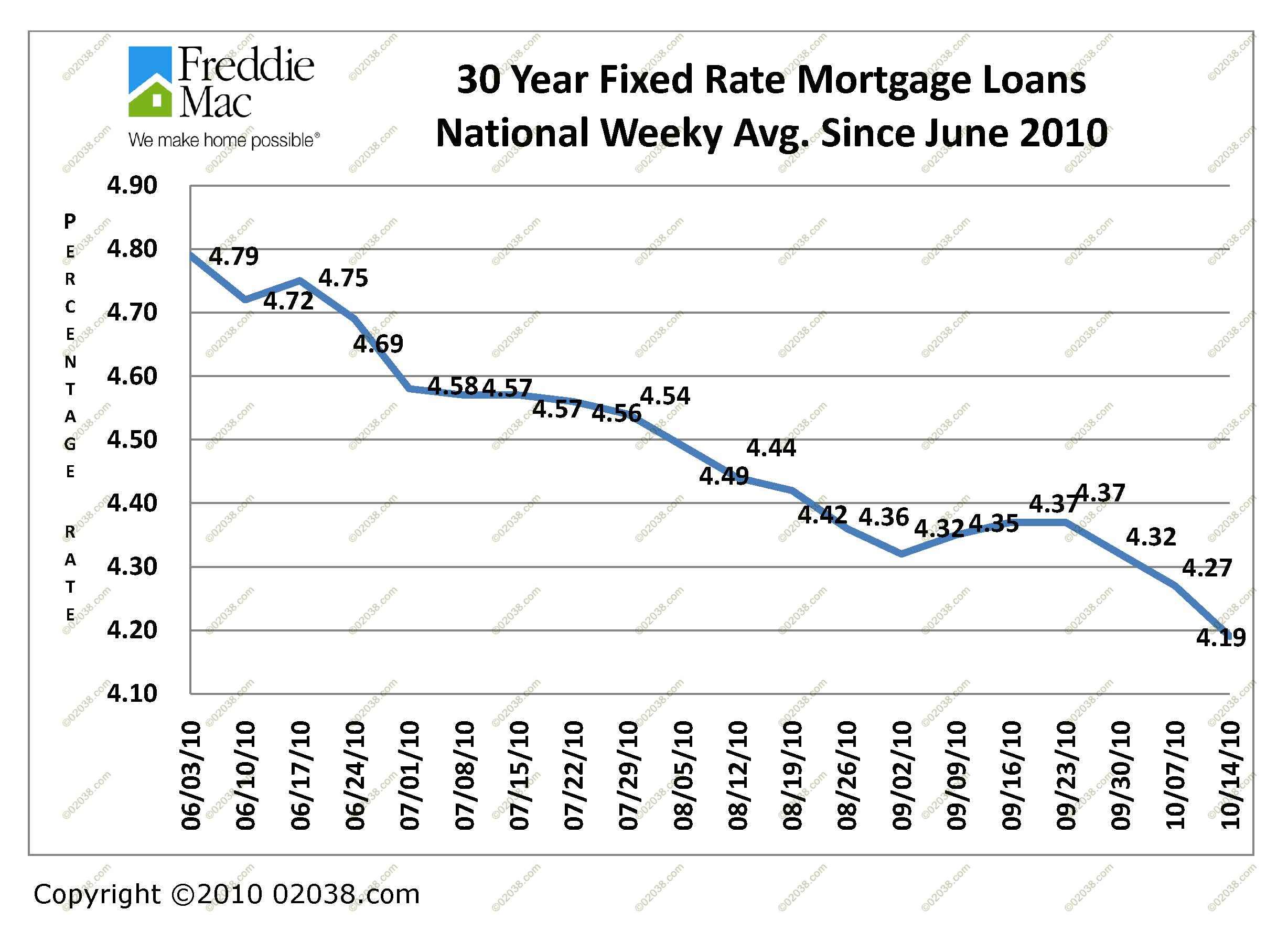

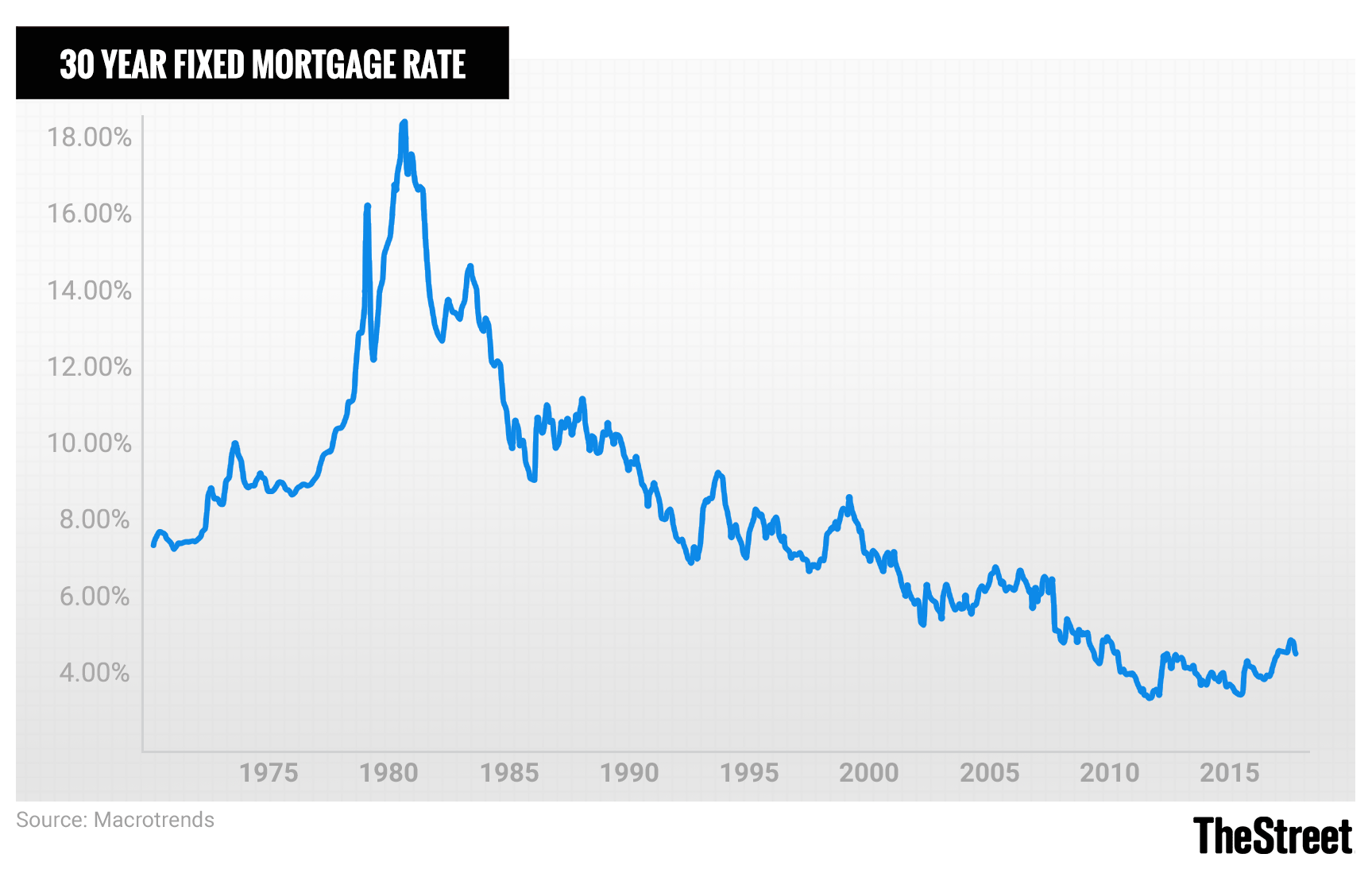

For example, on a 5-year ARM, the interest rate remains the same for the first five years, and then adjusts for the remaining term. Ninety-six percent of buyers in the United States have a fixed-rate mortgage — and 63 percent of that group has a mortgage rate under 4 percent, according to a March report by the Federal Housing Finance Agency. Check out some of our best HELOC lenders to start your search for the right loan for you. Refinancing into a 7/1 ARM with a 8.04% rate means your monthly payment toward principal and interest will be $737 for every $100,000 you borrow. This will be the payment for the first seven years, then your rate will change annually unless you refinance again. You could save serious money on interest by getting at least three loan offers, according to Freddie Mac research.

Will Interest Rates Go Down in May 2024? Mortgage Rates Forecast - The Mortgage Reports

Will Interest Rates Go Down in May 2024? Mortgage Rates Forecast.

Posted: Fri, 26 Apr 2024 07:00:00 GMT [source]

Annual Percentage Rate (APR)

The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms to find the product that’s right for you. For those who want to maximize their dollars to ensure the highest return on investment, finding the right mortgage is essential. Some borrowers might think the best way to save money is to pay off their mortgage faster—by opting into a shorter loan term with higher monthly payments—but that’s not always the case.

Faster, easier mortgage lending

Hard inquiries can take points off your credit score, but there's a way to shop around for a mortgage without harming your credit. Many or all of the products here are from our partners that compensate us. But our editorial integrity ensures our experts’ opinions aren’t influenced by compensation. If you don’t lock in your rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement in order to lower your interest rate costs. Mortgage rates are so high due to a number of economic factors. Supply chain shortages related to the pandemic and Russia’s war on Ukraine caused inflation to shoot up in 2021 and 2022.

At 6.15%, you would pay $609 monthly toward principal and interest for every $100,000 borrowed. The average 30-year FHA interest rate is 6.15% today, which is six basis points down from last week. The average 5/1 ARM rate is 7.40%, a 70-point increase from last week.

Mortgage options in California

At 7.30%, your monthly payment would be $686 toward principal and interest for every $100,000 borrowed — but only for the first seven years. After that, your payment would increase or decrease annually depending on the new rate. The 7/1 adjustable mortgage rate is up 72 basis points from a week ago, currently at 7.30%. The average 20-year fixed mortgage rate is 17 points up from where it was last week, and is sitting at 6.87%. Sticky inflation has pushed mortgage rates up in recent months, and we likely won't see them trend down until inflation starts decelerating again. We offer a variety of mortgages for buying a new home or refinancing your existing one.

What are today's mortgage and mortgage refinance interest rates? - CBS News

What are today's mortgage and mortgage refinance interest rates?.

Posted: Fri, 26 Apr 2024 12:55:12 GMT [source]

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. All home lending products are subject to credit and property approval. Rates, program terms and conditions are subject to change without notice. Not all products are available in all states or for all amounts.

Compare mortgage lenders side by side

The gap that has jumped open between these two lines has created a nationwide lock-in effect — paralyzing people in homes they may wish to leave — on a scale not seen in decades. For homeowners not looking to move anytime soon, the low rates they secured during the pandemic will benefit them for years to come. But for many others, those rates have become a complication, disrupting both household decisions and the housing market as a whole. Rates on new home loans now far surpass rates locked in by Americans with existing mortgages. A bank incurs lower costs and deals with fewer risk factors when issuing a 15‑year mortgage as opposed to a 30‑year mortgage.

Rocket Sister Companies

You’ll also want to compare lender fees, as some lenders charge more than others to process your loan. Locks are usually in place for at least a month to give the lender enough time to process the loan. If the lender doesn’t process the loan before the rate lock expires, you’ll need to negotiate a lock extension or accept the current market rate at the time. However, the Federal Reserve has indicated it will begin cutting rates in 2024 as the economy cools and inflation continues to fall. Assuming these trends hold steady, you can expect to see lower mortgage rates in 2024.

The annual percentage rate (APR) represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased or decreased after the closing date for adjustable-rate mortgages (ARM) loans. These rates, APRs, monthly payments and points are current as of ! They assume you have a FICO® Score of 740+ and a specific down payment amount as noted below for each product.

Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance (PMI) or homeowner's association dues (HOA), these premiums may also be included in your total mortgage payment. See our current mortgage rates, low down payment options, and jumbo mortgage loans. Conventional loans are backed by private lenders, like a bank, rather than the federal government and often have strict requirements around credit score and debt-to-income ratios. If you have excellent credit with a 20% down payment, a conventional loan may be a great option, as it usually offers lower interest rates without private mortgage insurance (PMI).

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. Kimberly is a career writer and editor with more than 30 years' experience. She's a bankruptcy survivor, small business owner, and homeschool parent. In addition to writing for The Motley Fool, she offers content strategy to financial technology startups, owns and manages a 350-writer content agency, and offers pro-bono financial counseling. Some lenders charge different interest rates for loans of different sizes.

No comments:

Post a Comment